Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Friday, March 10, 2023

Written By

Financial Planning | Investing | Alternative Investments | Portfolio

With the recent growth in index funds and retail traders, it can be quickly forgotten that alternative investments exist. Recent market volatility, however, may serve as motivation to seek out alternatives to public stocks.

Private markets are a direct alternative. This is the label given to investments in companies or assets that are not publicly traded on stock exchanges. Whilst they aren’t known for their transparency and accessibility, data suggests that they can often yield higher returns in exchange for less risk. This article seeks to explore why that is and what challenges lay ahead for private market investors.

One of the primary benefits of investing in private markets is the potential for higher returns. Private market investments tend to be less liquid than public market investments. This is because there are fewer buyers and sellers so transactions take longer to complete.

Whilst lower liquidity isn’t a good thing to investors, such illiquidity can result in a premium for investors. Investments are held for a longer period of time and there’s good evidence that private companies have higher growth potential than publicly traded firms.

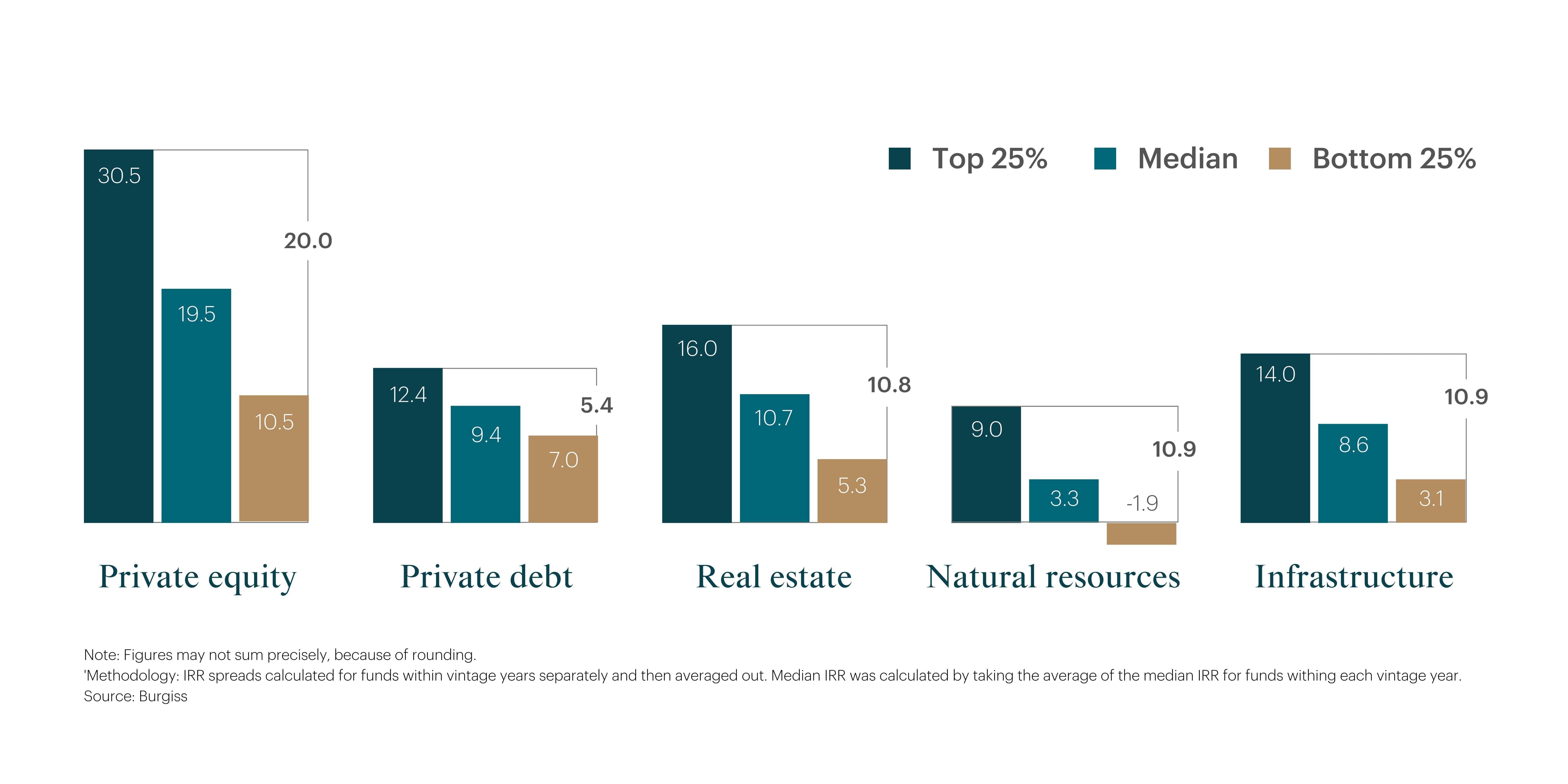

From 2010 to 2020, McKinsey reports that private markets grew 170% ($4 trillion) compared to global public market AUM’s 100% return. The report also highlights global fund performance by each asset type during 2008-18 vintages.

Market inefficiencies and information asymmetry help in exploiting higher returns in private investments. This is because in public markets, inefficiencies and undervalued pricinvg are instantly corrected via live trading.

It’s not just higher returns that attract investors to private equity, but also the diversification that it can offer with lower levels of volatility. The reason for this is, again, down to illiquidity. Valuations derive from periodic appraisals rather than daily market fluctuations. External shocks, market cycles, and technical traders make less of an impact on private investments.

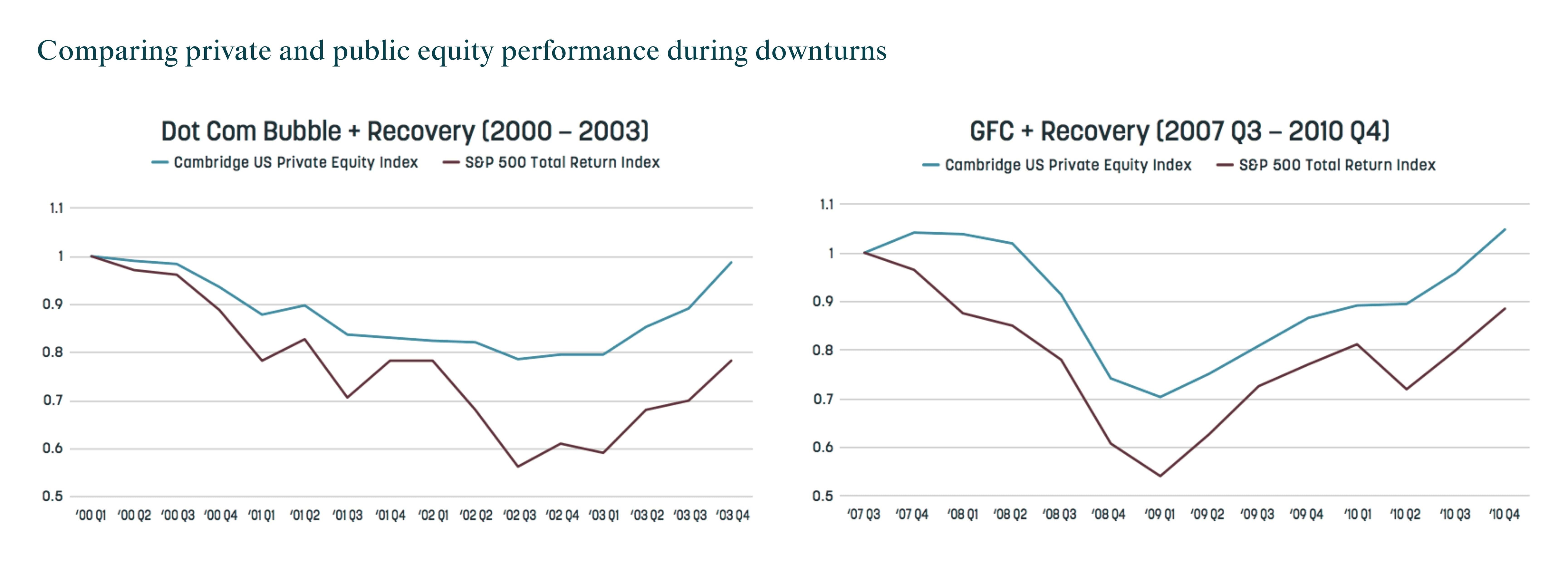

And, with fewer short-term shareholders, this can lead to companies focusing on long-term value creation rather than short-term earnings expectations. Mass sell-offs become less of a concern during a crisis, whilst the temptation for an investor to make emotionally-driven decisions also decreases. During both the Dot-Com Bubble and 2008 crisis, US private equity fared better than public market indexes.

When it comes to diversification, the inaccessibility of alternative investments is a benefit. Due to less involvement in trading algorithms sharing similar methodologies, prices aren’t as coordinated between investments. Idiosyncratic risk factors are more at play with private investments, whilst systematic factors relate more to public equity.

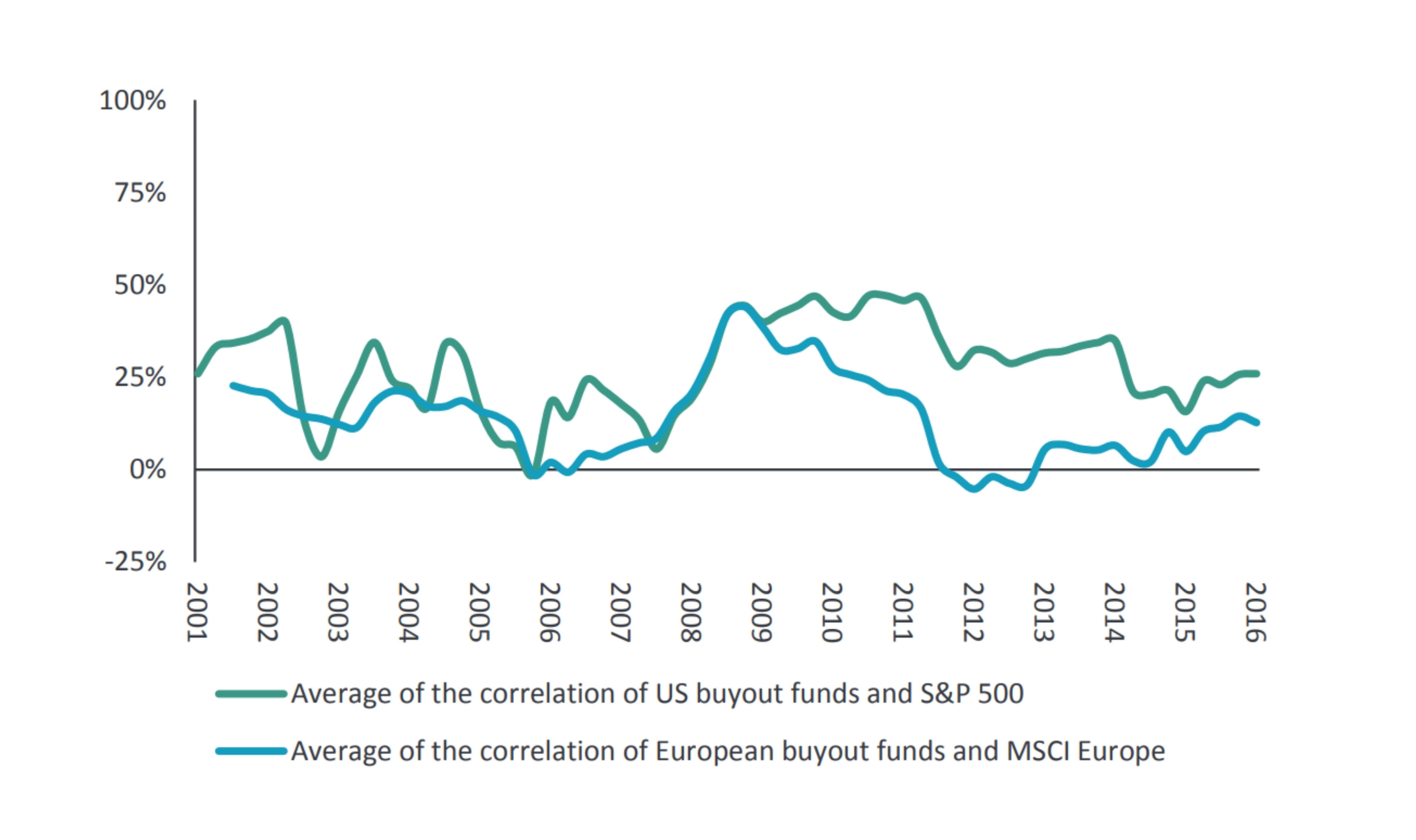

A common diversification strategy is to mix public investments with private. When it comes to private buyouts’ correlation to public equity, Europe is more promising because it’s more fragmented than the US.

Liquidity

Unlike publicly traded stocks, which are bought and sold at any time, private equity investments are typically held for several years before they can be sold. This means that investors must be willing and able to tie up their capital for an extended period.

The biggest threat this poses is cash flow issues, particularly in a time of rising debt repayment rates, inflation, and suppressed real wage growth. A competent wealth management team can help mitigate this threat by using secondary markets, diversifying the portfolio, and potentially using co-investment structures.

A hybrid approach is common, meaning that an investor is exposed to both public and private investments. This can alleviate liquidity concerns whilst improving diversification.

The economic region of investment

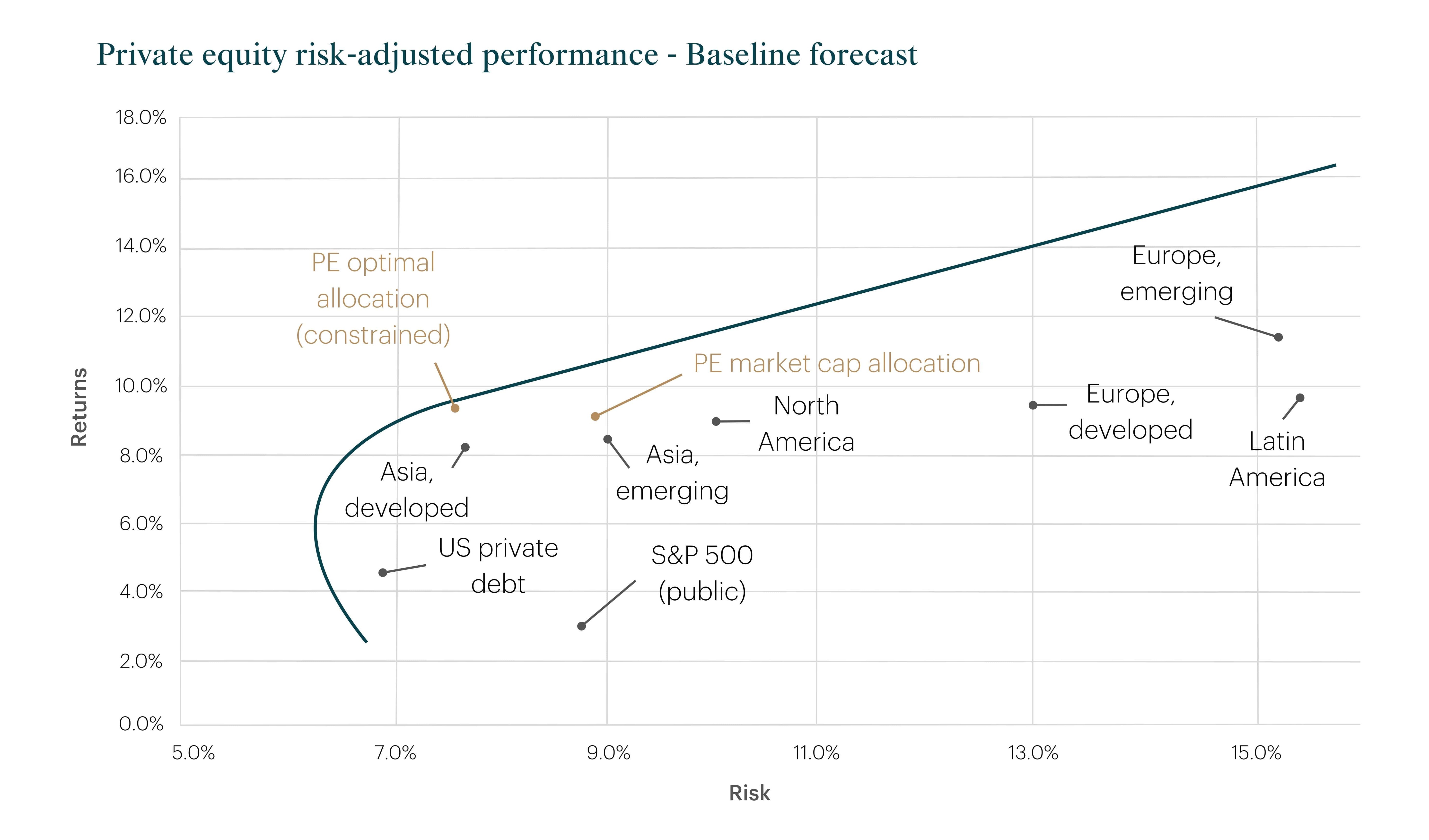

One of the most effective ways to diversify a portfolio, particularly with private investments, is via geography. Using the Beneficient Company Group’s framework, Oxford Economics reports that private equity in emerging markets are forecasted for higher returns than in developed ones. However, this comes with considerably higher risk and often below the geographic efficient frontier.

To make things more complicated, such risk-adjusted returns do not factor in diversification benefits. It is also important to geographically allocate in accordance with your risk appetite and goals.

Philanthropy

Finally, it’s important to consider that philanthropy is a part of many investors’ goals too. Private equity is a good way to support causes that an investor cares about, particularly as it gives access to low-cap initiatives in their early stages. Inevitably, this can present higher risk to investors as well as lower returns.

A consideration here that ties in with geographical diversification is Asian philanthropy, which is growing at an unprecedented rate. Rapid economic growth in areas like India offers a unique opportunity to create positive social change, grow networks, and still capture generous returns.

Because philanthropy in Asia often aligns with government goals, there are growing tax benefits to incentivize such investments. For example, Singapore granted a 250% tax deduction for qualifying donations in 2009. And, in 2014, India imposed a rule that large firms must invest 2% of post-tax profits to corporate social responsibility.

By their very nature, private investments have varying degrees of accessibility. A common way to conveniently invest in private equity is through a fund. By pooling together capital from many investors, it’s possible to gain exposure to private markets without needing to be an accredited investor or a high-net-worth individual.

Other ways to access private markets include crowdfunding platforms, working with broker-dealers, and angel investor networks. The latter is for high-net-worth individuals that are attracted to scalable early-stage startups. The vast networking benefits exploit the information asymmetry that makes private equity profitable. Equally, crowdfunding is a more globally accessible way to promote startups - particularly for philanthropic motivations - that demand less capital.

At Globaleye, we cannot only help in portfolio construction that promotes geographic diversification, but also grant access to exclusive investment opportunities and private markets. Our commitment to adding value to people’s lives through community-driven projects is matched by our commitment to bespoke financial planning and tax-efficient investments.

For better web experience, please use the website in portrait mode