Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Friday, January 13, 2023

Written By

Retirement Planning | Financial Planning | Investing

Having a pot of $1 million can provide a significant amount of financial security during retirement, but the exact amount of time it can last will depend on a variety of factors such as your lifestyle, spending habits, and investment returns.

According to conventional wisdom, you should prepare to live off 4% of your nest egg annually when you retire, as this would provide your investments with enough cushion to provide income for a long time in retirement. However, according to Morningstar researchers, this figure could be deemed too ambitious, and the new figure suggested ought to be 3.3% based on recent market trends.

If we consider what this means in real terms, and we assume a conservative 4% withdrawal rate, $1 million can provide an annual income of $40,000. If we assume zero or very little investment growth on the capital, this could cover basic living expenses such as housing, food, and healthcare for approximately 25 years, without any other additional spending. However, if you have higher expenses or a more luxurious lifestyle, your retirement funds may not last as long – using the same capital as you will spend or need more income each year.

Numerous personal finance factors influence how long $1 million will last in retirement, some of these factors include:

1. Desired age of retirement: The average retirement age globally is between the ages of 65 and 67. However, a recent Gallup survey indicates that 61 is the average age at which people actually retire. The truth is that we don't always get to make that decision. The earlier an individual retires, the less time they will have to save and accumulate income for retirement, but similarly, they need to make their capital last longer hence, investing early and making your wealth work for you is essential to reach your retirement goals.

2. Investment strategies: When creating a retirement plan, it is important to implement various investment strategies to ensure a diverse portfolio and mitigate risk. One key strategy is to diversify across different asset classes, such as stocks, bonds, and real estate. This can help spread risk and potentially lead to better overall returns. For example, stocks have the potential for higher returns but carry more risk, while bonds tend to have lower returns but are generally considered less risky. It is also crucial to have a long-term investment horizon and avoid trying to time the market or make short-term trades. Instead, focus on building a well-diversified portfolio and sticking to a consistent investment plan.

3. Health care costs: As people age, they tend to require more medical care and may develop chronic conditions that require ongoing treatment. These costs can add up quickly and can eat into retirement savings. Additionally, many retirees are on fixed incomes and may not have the financial resources to cover unexpected medical expenses. Healthcare costs can have a significant impact on retirement income, as they can consume a large portion of your retirement savings and income. You need to take these costs into consideration and find ways to manage them, such as purchasing long-term care insurance or investing in a health savings account.

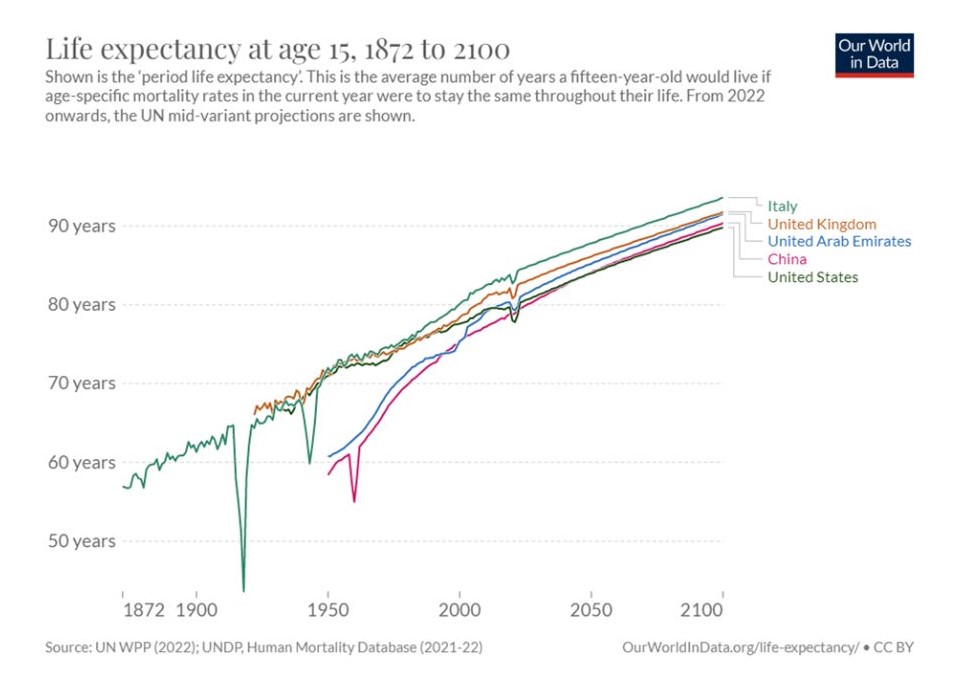

4. Life expectancy: Life expectancy plays a significant role in determining retirement income because it affects how long an individual is expected to live in retirement and, therefore, how much income they will need to sustain themselves during that time. This can affect the amount of money an individual needs to save for retirement and the types of investments they make to ensure that they have enough money to last throughout their retirement years. As of 2020, the average global life expectancy age was 72 years. However, in more developed countries, life expectancy is considerably higher, but globally we expect it to increase in the coming decades, as shown in the graph below. With a longer life expectancy rate, there comes a need to have more retirement income to sustain a comfortable lifestyle for a longer period of time. This can affect the amount you need to accumulate for retirement and the types of investments you make.

5. Inflation: Inflation affects retirement income by decreasing the purchasing power of fixed income streams, such as pensions and Social Security benefits. As prices for goods, services and even healthcare increase with inflation, you are left with less disposable income to spend. Additionally, you should be mindful of the impact of inflation on investment returns. For example, if your investment portfolio is not adjusted for inflation, your purchasing power will decrease over time. Overall, inflation can significantly impact the ability to maintain a comfortable standard of living, which is why you need to consider the effects of inflation when planning for retirement.

So how long will your $1 million retirement income last where you live?

United Kingdom: 21 years

UAE: 20 years

Singapore: 21 years

Whilst these are estimates on the longevity of your retirement income, they can be used as a helpful benchmark to assess how your investment strategy needs to be constructed to account for your fixed costs.

With the help of a qualified financial adviser, you can be assured of achieving your retirement goals, without having to worry about rebalancing your strategy, adjusting your risk profile, and gaining access to exclusive investments to accelerate your portfolio’s performance.

For better web experience, please use the website in portrait mode