Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Friday, February 24, 2023

Written By

Financial Advice | Investing | Portfolio

Multi-asset allocation funds are a way to gain exposure to a variety of assets in a very convenient way. The main benefit of having a diversified portfolio with varying asset types is to reduce systemic risk. If the stock market collapses, it doesn’t necessarily mean that gold and bonds will. The idea being, asset winners rotate year on year, and reliably predicting next year’s winner is beyond most investors’ ability.

To varying degrees, most asset classes share a positive correlation. This can be a problem. For example, a positive correlation between assets means that when one asset struggles, the entire portfolio will suffer too. However, some assets share a negative correlation, such as European shares and US government bonds (although this is not always the case, as 2022 showed). In fact, bonds have an inverse relationship with many assets.

The objective behind multi-asset funds is to produce a well-diversified portfolio. This diversification is a quick way to achieve capital growth but with reduced risk.

It is a common misconception that because, on average, equities provide higher returns than bonds, then adding bonds into a portfolio would result in worse returns.

However, returns mean very little without the context of risk. In the same way that a 1000/1 sports bet could make you rich, the bet within the expected outcome is crucial. In this instance, Expected Value would be used to assess the returns relative to the risk.

If bonds are expected to yield half the return of equities, it’s easy to see why some investors have no appetite to add them to a portfolio. But, the biggest misconception here is that your returns will reduce to the same degree as your risk. This isn’t necessarily the case. Very often, the volatility of the portfolio decreases more than the decrease in returns. The risk-return profile has improved, meaning risk-adjusted returns have gone up, not down.

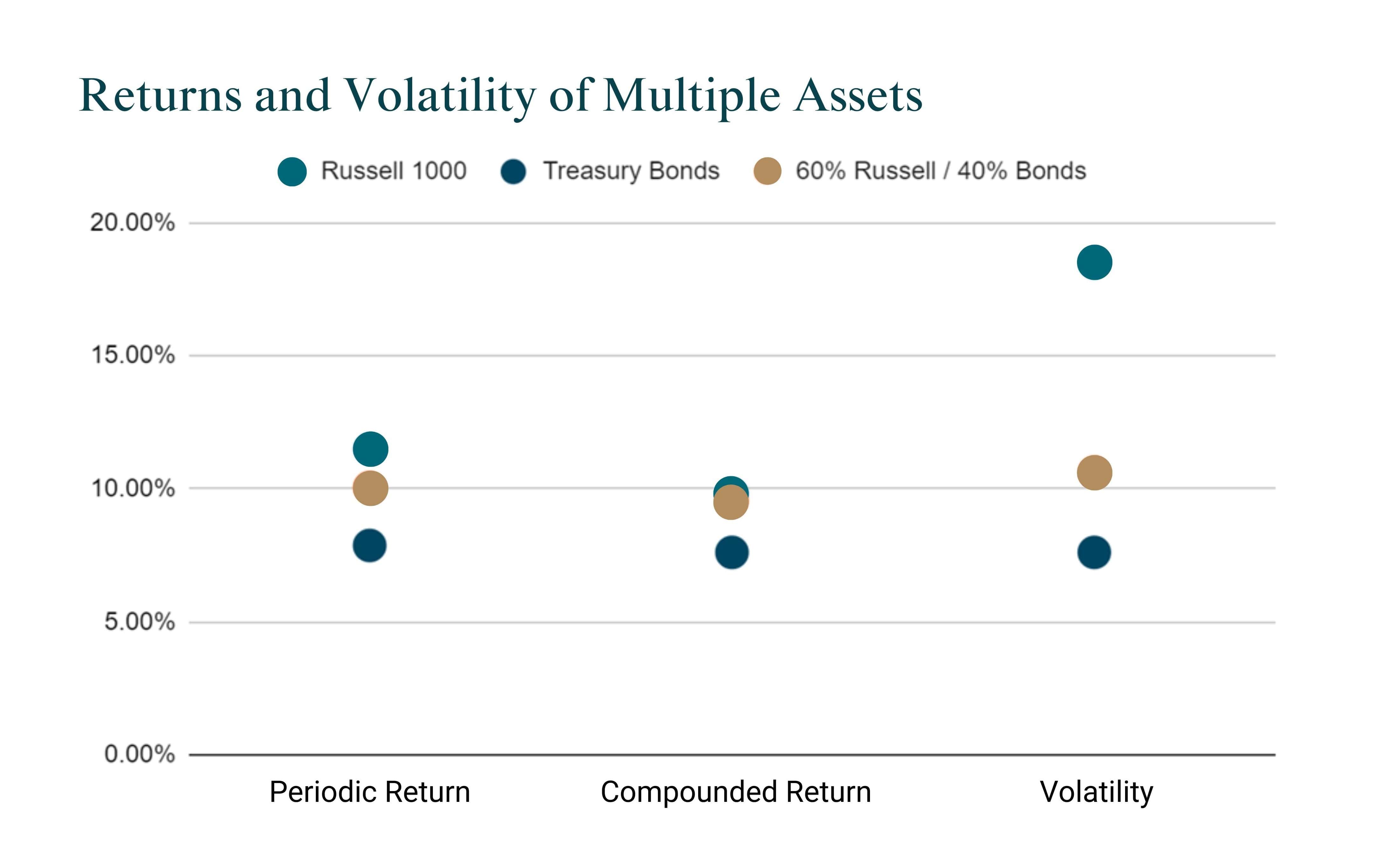

A CFA Societies Canada report of the returns of Russell 1000 and 10-year Treasury Bonds between 1990 and 2014 is a clear example. Graphing the results below, it’s clear to see how risk can be drastically reduced with only a small compromise in returns.

This data demonstrates that a traditional 60/40 asset mix would have resulted in 0.28% less compounded returns than Russell 1000, but volatility almost halves from 18.49% to 10.63%.

Arguably, for those with a greater appetite for risk, 100% of equities would have returned more. But, past performance is not a guarantee of future results, so such vast reductions in volatility should be taken into consideration by investors of all risk profiles. This same concept of improving risk-adjusted returns scales when adding more asset classes that do not share strong positive correlations.

Asset allocation is the primary part of portfolio creation. It is the most direct way of reflecting an investor’s goals. The main asset classes to pick between are:

Because it takes a lot of capital to invest in property, for example, funds become a viable way to gain exposure to a variety of asset classes. However, there are two ways to go about this allocation: strategically and tactically.

Strategic asset allocation is the creation of a portfolio using an initial asset mix that reflects the investor's objectives, risk tolerance, and time horizon. The portfolio is then rebalanced on a periodic basis to ensure that it remains in line with the investor’s target allocations.

The downside of strategic allocation is both your personal conditions and market conditions can change over time. Maintaining a fixed asset allocation within your portfolio ignores market opportunities and changes in your personal situation. Tactical asset allocation is an active approach, where short-term adjustments in the asset allocation are made.

Sometimes, this can result in a “sell your winners, buy your losers” approach, particularly for value investors. So, if property has performed well whilst equities have experienced a bear market, the investor may decide to sell property funds in favour of undervalued stocks. This encourages retaining a balanced asset mix, because “winning” assets can overexpose and lead to greater risk within your portfolio over time. However, reallocation decisions usually require more than price/performance data, as market conditions, economic indicators, and other factors should also be considered.

This leads to the idea of portfolio efficiency. Whilst multi-asset allocation funds are useful investment tools to reduce risk, it doesn’t replace the need for portfolio efficiency evaluation directly. This is the process of optimising the risk-return tradeoff. Assessing efficiency can help prevent the naïve portfolio diversification effect, which refers to the belief that holding a large number of assets always leads to diversification benefits.

Opting for a single multi-asset fund is advised for beginner investors because fund managers usually outline the asset mix and other key descriptions. However, when mixing funds, investments can overlap and can unknowingly increase concentration risk. So, estimating the asset allocation is now up to the investor.

Some things to consider when picking funds are: how active or passive they are, asset mix and correlations, past performance, currency denomination, tax implications, fees, and how it impacts the overall portfolio.

With the help of a qualified financial adviser, you can be assured of optimising your portfolio through effective multi-asset allocation. Through understanding your risk appetite, financial goals, and access to exclusive investments, a portfolio can be constructed that optimises your risk-adjusted returns.

For better web experience, please use the website in portrait mode