Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Friday, February 03, 2023

Written By

Financial Advice | Investing | Portfolio

The consensus among economists is that 2023 will be a year of high inflation, zero economic growth, and ongoing supply-chain issues. The key question for investors is how, if at all, do you react to these forecasts and are there any opportunities?

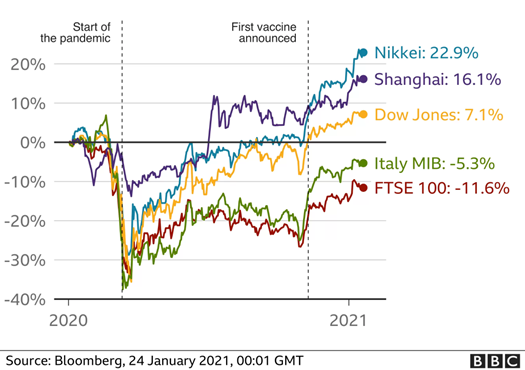

To clarify a common misconception, the high chance of recession does not mean there will be a market crash. The reason for this is that the market is speculative and forward-looking, nor do prices strictly reflect sales, income, and productive capacity. The best evidence of this was through the pandemic. A time of poor productivity, reduced spending, supply issues and GDP collapse amounted to a bull market after an initial crash.

In 2021, which was still blighted with months of lockdowns, the best yearly FTSE 100 gain was recorded since 2016. It is much easier to predict the economy than it is markets.

The biggest threat to both consumers and investors this year is inflation. Eroding away the value of your cash savings, inflation is expected to remain above the 2% target in 2023. History tells us that the median time it takes to drop to below 3% inflation from 8% is around 10 years. Most economists predict that inflation has already peaked for the US and UK, but will continue to be elevated throughout the year.

During periods of elevated interest rates and inflation, private credit is often preferred over private equity. Particularly in a floating rate structure, newly raised rates are reflected in the lending terms.

JPMorgan’s FactorResearch shows that 27% of investors believe stocks are the best inflation hedge. In truth, monthly US returns remain reasonably consistent across all levels of positive inflation, with slightly lower-than-average returns when inflation is between 5 and 10%. In real terms, equities weaken with inflation.

This is conducive to the idea of diversifying into debt products. This isn’t to say investors should abandon equities - they are a core part of most investors’ long-term strategies. Current inflation is derived from rising energy prices and profits, so this is one industry that proved to be inflation-hedging within equity. Energy historically performs well in high-inflation environments, whilst automobiles and consumer goods do not.

Global hedge funds are reportedly planning around the inevitable 2023 inflation risk. They are doing this with inflation-linked bonds and private credit, as well as commodities. Furthermore, the US dollar is still strong, and with two more hikes expected, we may see it end the year strongly too. So, US-backed assets may protect from the currency risk that engulfs many other countries, such as the Indian Rupee and Turkish Lira.

2023 may be a year of opportunity depending on how active of an investor you are. More importantly, it is about protecting the wealth you already own. The good news is that the recession is expected to be less painful than previous ones, inflation will cool - even if it’s not to the 2% target - as well as some good news, like a strong jobs market in the US and UK.

One of the biggest threats during turbulent times is psychological biases. The frequent negative headlines, confirmation bias and clickbait, along with a fear of seeing your portfolio dwindle. It is in these times to remind oneself firmly of the investment strategy and stick to it. Panic selling during a crash is one of the core reasons investors seek a wealth manager - to stop such things from happening.

Cash flow issues occur during recessions, so insolvency becomes a greater risk. No matter how much wealth you have, cash flow issues can occur. A prime example of this threat is with a property-forward portfolio. The UK property market is expected to drop around 10% in 2023. As mentioned above, it would be a poor time to sell, yet landlords may feel forced to. If the recession causes tenants to struggle to make rent payments, there could be issues meeting the higher mortgage repayments.

Protecting against such an insolvency risk early on is key. Some ideas of what this may look are; pre-emptively switching to an interest-only loan for a few years, being better prepared for maintenance costs, hiring a new property manager, and diversifying the risk by renting out individual rooms to loan-receiving students as opposed to one family.

Likewise, being a business owner during a recession requires similar considerations. For example, ensuring you have products and services that are demand inelastic, such as recession-proof necessities. Some other ideas might be building cash reserves and creditworthiness, being conscious of rising repayments and leveraging, not overordering on inventory, and securing finance before you need it.

And, it’s not only business owners that should have buffer assets. Those who are already living from or liquidating their portfolio each year should have a sufficient buffer. If markets do react poorly to the recession, this buffer can be used to prevent selling at low prices.

A year may feel like a long time, but the longer your investment time horizon, the shorter it is in relation to the bigger picture. So, if you’re 20 years from retirement, a turbulent 2023 may be nothing more than noise.

Furthermore, for those using dollar-cost averaging techniques, it makes little difference. There may be a concern when approaching the end of an investment time horizon (i.e. cashing out for retirement in 3 years), so it’s normal to adjust your portfolio accordingly. Fewer equities, for example, is a common transition, as well as value investing as opposed to growth investing to mitigate volatility.

However, regardless of time horizons, 2023 is seeing a revival in 60/40 portfolios. There is also a push towards multi-asset strategies due to the rise in real yields. Many analysts view the upcoming recession as being healthy, with seemingly rational price corrections and a step away from inflated growth stocks. So, even with 60% equities, index funds and value investing are becoming preferred to growth.

Ultimately, 2023 is a year of opportunity or belt-tightening depending on your goals. Besides developments in geopolitics, there is nothing yet to strongly suggest a major crash or deep recession will occur. It is always recommended to consider the worst-case scenario, however, and cooperate with a wealth manager to diversify your risks and capitalise on emerging opportunities.

On that note, we would like to introduce our new model portfolios. After extensive research, we have developed a range of portfolios that offers broad global diversification for a variety of risk profiles. Utilising over two decades of experience, our model portfolios are designed to bring you closer to your financial goals. Speak to one of our advisers today to ensure your portfolio accelerates no matter what the market condition.

For better web experience, please use the website in portrait mode