Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Friday, December 16, 2022

Written By

Financial Planning | ESG | Sustainable portfolios | Investing

With the shift in environmental factors and the rising concern around climate change, investors are increasingly becoming more conscious about what and where they invest. Extreme weather, rising sea levels, and severe drought are becoming more obvious every day. We are living with more awareness than ever before, and a fundamental desire to effectively create change.

Growing research shows that more and more people are considering environmental, social, governance (ESG), and ethical factors when devoting their capital towards investing. Rather than only looking at financial gains, investors are increasingly cognizant of the organisations they invest in, and how they do it.

There is a deepening awareness of how every investment has the potential to make an impact, resulting in demand for socially responsible opportunities. Now more than ever, we have realised where and how we put our money has the power to make a difference.

In this article, we explore ESG investing, what it is, how you can make the right choices and how you can take the first step towards being an ethical investor.

Environmental: These factors look at how a company honours (or doesn't honour) the environment in its practices. They can include how it works to conserve energy and future proofs against further damage to our climate.

Social: This component takes into consideration how a company's processes affect the people involved. Does the company take into consideration the health of its employees? Does it offer fair and equal pay? Or do the company's goals deteriorate the wellbeing of those working to bring them to fruition? This is where a closer look at inequality and other instances of abuse comes into focus.

Governance: Lastly, this factor looks at leadership and practices. From how a company is run, to its board inclusion, to its C-level executives’ strategies. Governance also considers if a company has had a history of illegal or unethical activity.

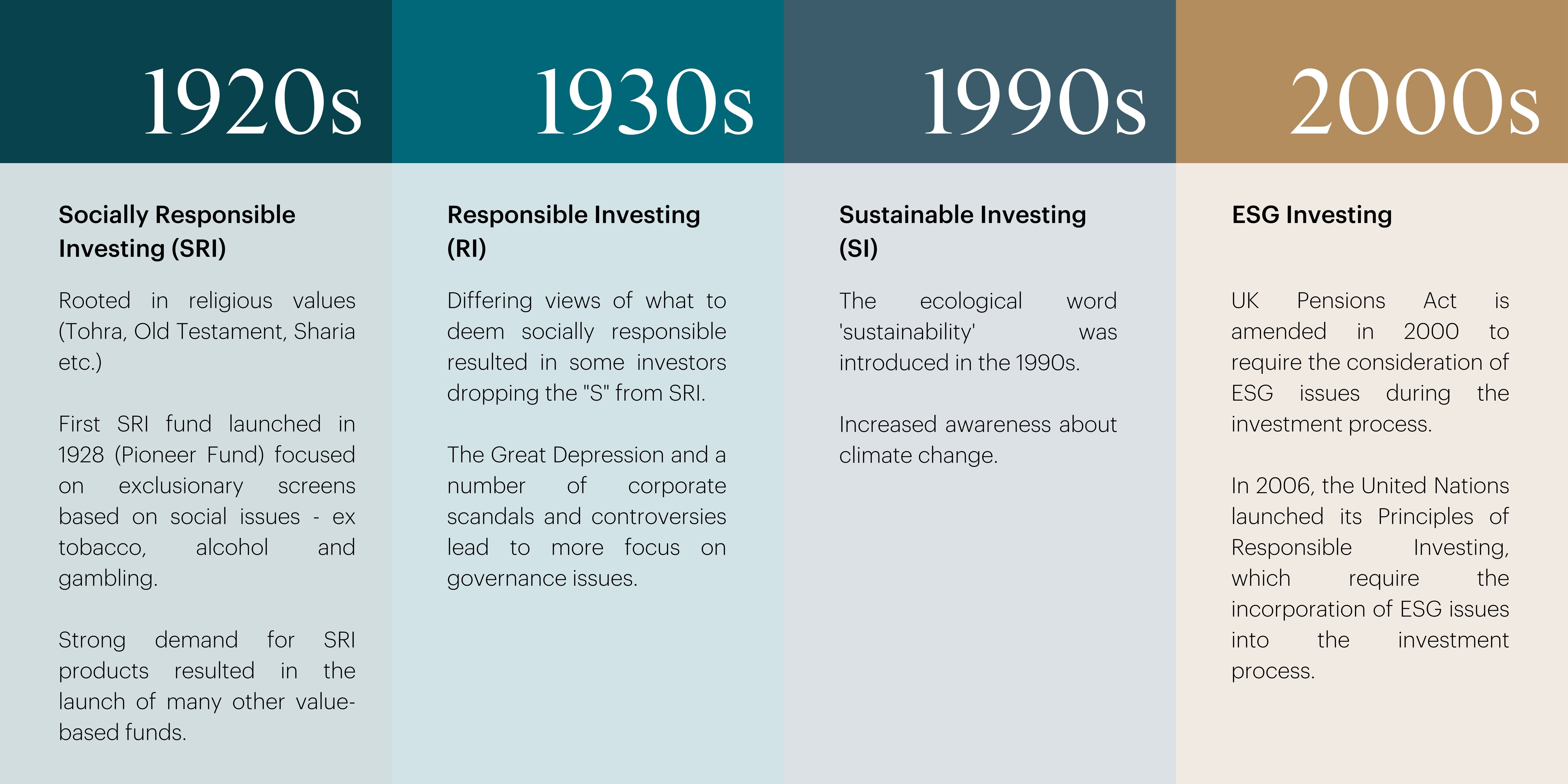

The history and evolution of ESG investing

Most professional investors are now clarifying their motives and strategies for implementing ESG, even though these are more complex decisions in many cases. On an organisational level, an increasing number of institutions and wealth managers are striving to contribute to a better world – or are at least trying to align their asset management with their values in sustainable development.

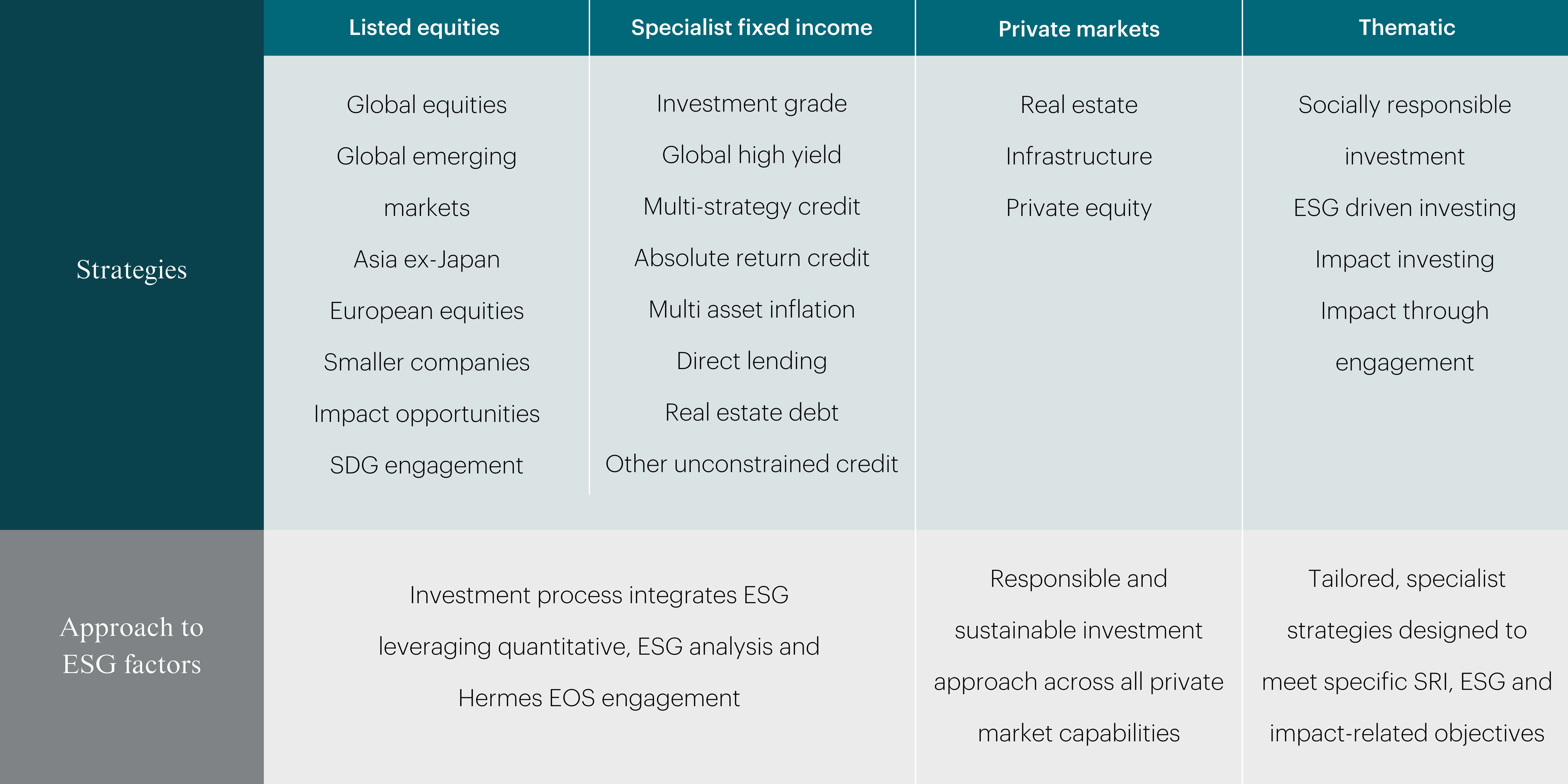

Many are looking to become better investors by integrating ESG into their investment process. Luckily for investors, ESG investing has become more integrated across all asset classes in recent years. Senior leaders are actively making sure that ESG analysis is being integrated into the fundamental financial activities carried out by analysts and portfolio managers. And with shareholder activism on the rise, ESG is increasingly becoming a focus of these interventions.

S&P’s latest analysis showed mounting evidence that ESG funds outperformed their peers and the broader market during the pandemic. Their analysis included 26 ESG exchange-traded funds and mutual funds with more than $250 million in assets under management. From March 5, 2020, to March 5, 2021, 19 funds grew between 27.3% and 55%, outpacing the S&P 500 index’s 27.1% rise.

Investors also have more choices than ever before. The number of sustainable funds available to U.S. investors grew to almost 400 last year — up 30% from 2019 and a nearly fourfold increase over a decade.

Whilst you may be considering ESG factors when investing, it’s still important to understand your financial position to select investments that are right for you and your goals. An investment that matches your values or scores well against ESG criteria isn’t necessarily right for you, even when these are important.

You should ensure investments consider your position alongside these, with factors such as those below playing a role.

• Investment goals

• Investment time frame

• Diversity of other assets

• Risk profile

With so many different pieces of information to pull together, investing can be complex, whether you want to make ESG part of the process or not.

We’re here to help you create a portfolio that considers the above and more to guide you towards your aspirations and goals.

For better web experience, please use the website in portrait mode