Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Friday, June 24, 2022

Written By

Sustainable portfolios | Investing | Alternative Investments | Portfolio

As the old saying goes, time in the market beats timing the market.

This well-known maxim arguably encapsulates an essential piece of investment advice – to stay invested - and is timely given the current environment and recent drops in global markets.

Evidence shows that remaining invested, despite market corrections or periods of decline, is one of the best things you can do for your overall wealth.

History shows that volatility in the markets is not long-term, and while the highs may spark lots of optimism, the lows can bring even greater pessimism. The current stock market direction of travel has left much uncertainty about how you should and should not react.

Experienced investors usually focus on their medium to long-term goals, and better manage their emotions during volatile market periods. They believe that the longer your funds are invested, the more likely you will benefit from periodic market fluctuations.

So here are a few principles to follow to help you keep your emotions in check during the current market turbulence we are facing:

A well-defined investment strategy based on a good understanding of your goals or objectives, along with understanding your personal attitude to risk for all market conditions will help you make better investment decisions.

You can also benefit from working with a firm and an adviser that genuinely cares about your long-term goals as much as you do. Let them reassure you that you're on track to achieving your pre-defined plan.

Market timing is not an investment strategy as it never works – ask industry professionals and they will tell you the same. Nobody can predict the optimal time to invest and exit the market, and those that suggest otherwise have most likely got lucky.

Getting it wrong could have a disastrous impact on your portfolio's returns, but remember, market corrections are not forever; they always rebound. So even in periods of short-term decline, the market’s recovery over the long term has rewarded those who remain invested.

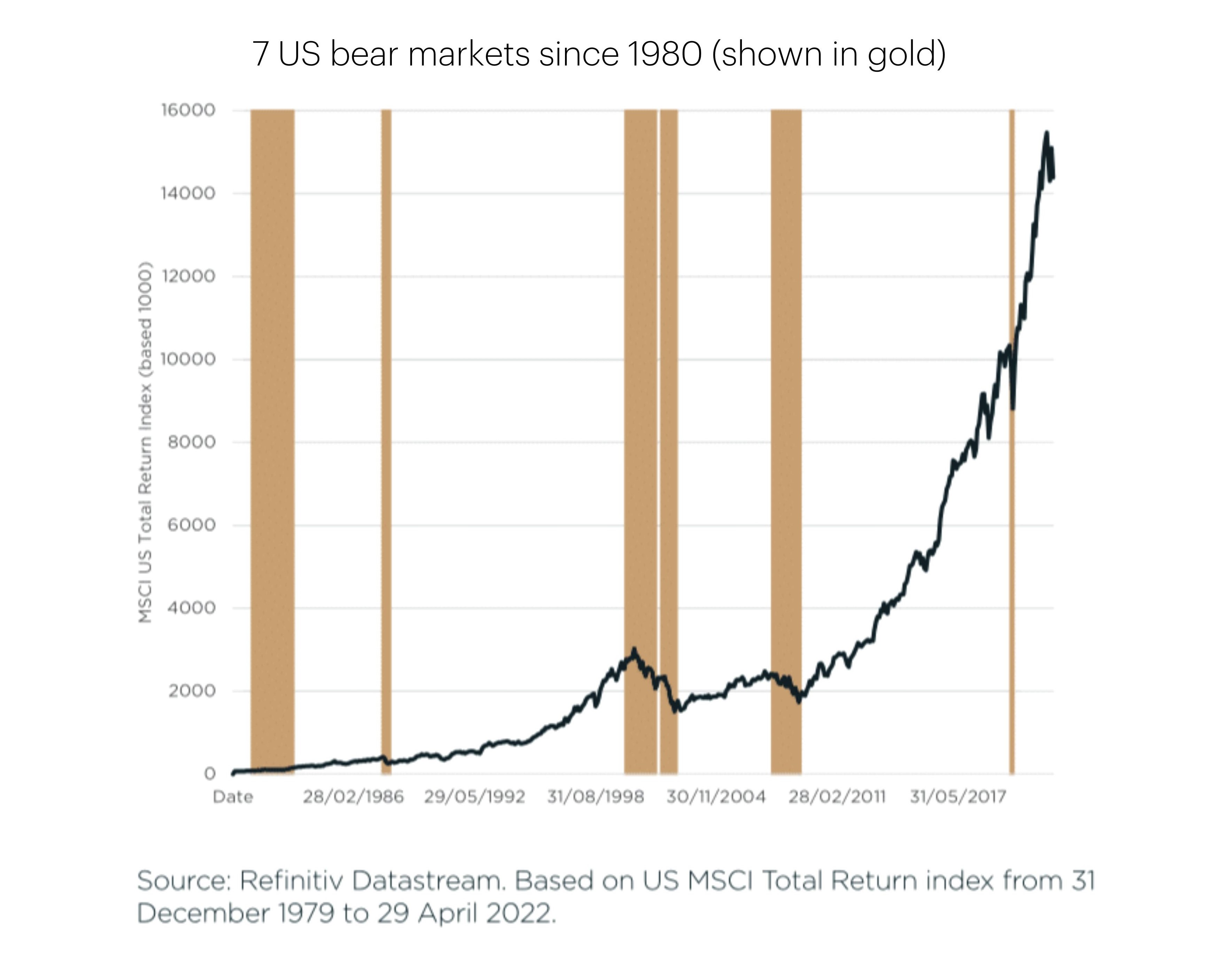

The chart below is a great example of staying invested even during market declines. As you can see, the markets experienced several bear markets, yet overall positive returns exceeded these periodic declines.

Information is readily available now more than ever, and market alerts, financial and business TV, and breaking news cause investors to act on emotions rather than being rational.

Making quick decisions can result in buying high, from the thrill of higher returns, and selling low from fear and panic amid declines. Here's where your adviser can add value by giving you their unbiased opinions and resourceful insights to help you make better investment decisions.

Diversification is without a doubt the best defence to deal with volatile market conditions, particularly if you can hold investments that are not directly correlated within a portfolio, as this gives you the best chance of reaching your long-term investing goals – through all market conditions.

Another argument is the one of active management versus passive during periods of volatility. Whilst holding a cheap tracker ETF has benefits on cost, it will track the index as it falls. Whereas a hybrid, or Core-Satellite approach, has the potential to produce positive returns during periods of market corrections.

Hence, professional investment management may be valuable to you during times like this.

Should you have any questions or would like to speak to someone to help keep your emotions in check during this period of market volatility, I’d recommend speaking to an experienced adviser to help guide you.

For better web experience, please use the website in portrait mode