Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Friday, November 11, 2022

Written By

Financial Planning | Investing | Portfolio

As concerns about a recession continue to spread, many people are pulling their investments out of the market while planning to jump back in again when they feel conditions are right.

Regardless of whether a global recession occurs in the near future or not, focusing on dire economic news can lead us to lose sight of the disciplined, long-term outlook that determines investor success.

There is no doubt that investors’ portfolio decisions are heavily influenced by their egos and emotions even at a time of market stability, so what about during market volatility?

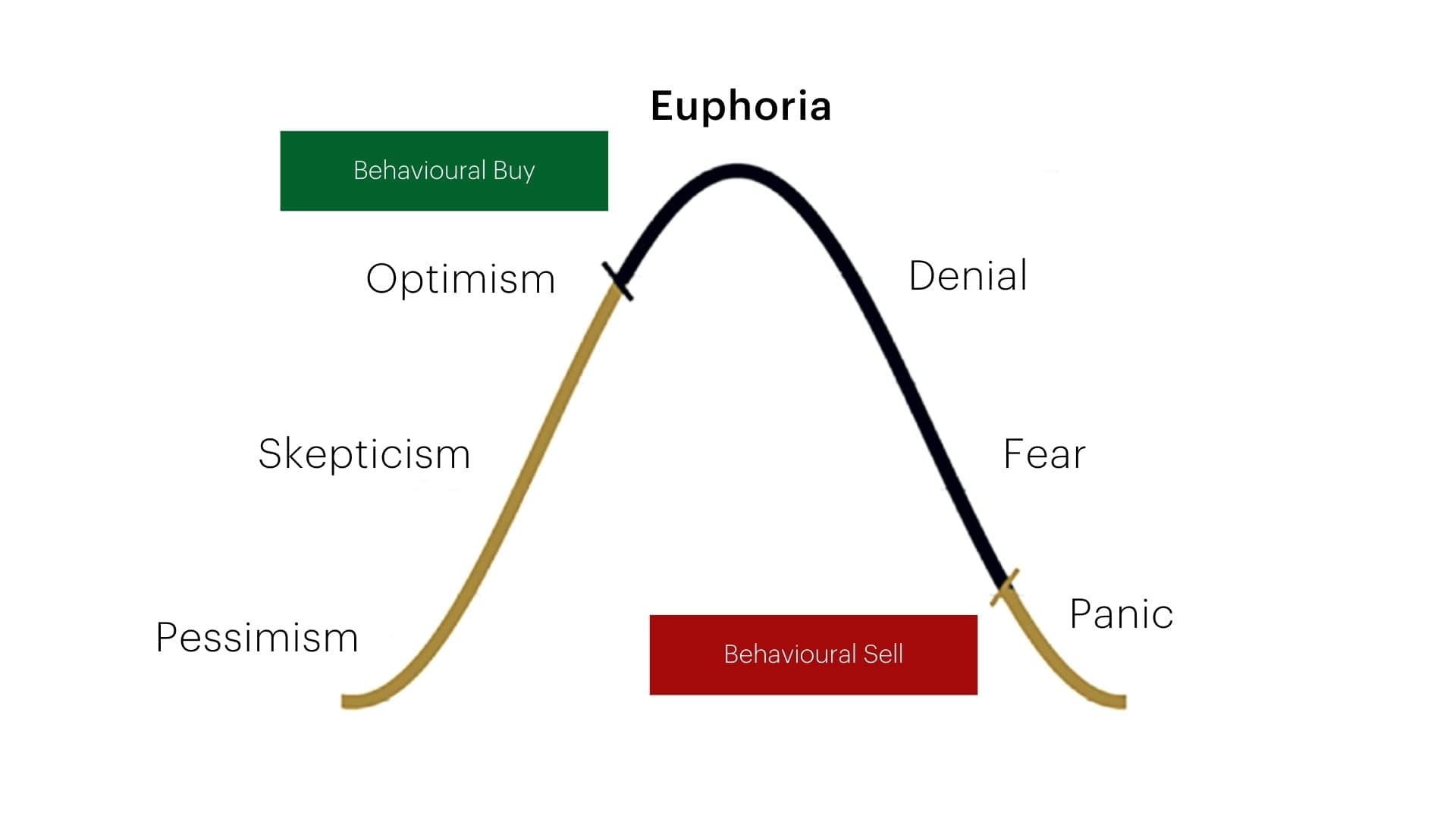

Financial markets are driven by human emotions as much as market movements and economic cycles. When markets are going up, so does your confidence. There is a sense of euphoria when returns are favourable, even though you don’t exactly know where the market has peaked. Your portfolio is at its peak of risk at this point.

On the other hand, falling markets cause you to lose confidence in your investments and feel nervous, becoming more tense and acting on emotion. Although it is impossible to predict the markets and forecast volatility, there is a sense of despondency when you see negative growth or the dreaded red in your portfolio. However, a rational and successful investor knows that at this once in a decade event, there is maximum opportunity.

With a diversified portfolio, you are less likely to feel extreme emotions as your portfolio expands and contracts because it is protected from extreme highs and lows of market volatility.

The graphic below shows a typical cycle of emotions faced by investors. Everyone who seeks to invest starts with a sense of pessimism, especially first-time investors with little to no market knowledge. Gradually moving into a sense of euphoria when things are working in their favour, before quickly falling into the trap where investors lose foresight and confidence, panic. Every investor passes through each of these phases before they finally identify the patterns and start making rational decisions when it comes to their investments.

It has been proven that a typical investor’s response to losses is stronger than their response to corresponding gains. This means that seeing your portfolio fall 10% hurts far more than the enjoyment you get from seeing your portfolio rise 10%. Acknowledging this asymmetry can help you to navigate turbulent markets better and help you realise that more often than not, your emotions are not your friend.

In times of volatility, timing the market may seem tempting, but doing so is impossible and may be a costly mistake. The opposite of market timing is buying and holding as the market goes through its cycles. Data has shown that long-term strategies are able to wade through market volatility and provide growth for those who remain invested over the term. A wealth manager can offer expertise and guidance to help you focus on actions that add value. This can lead to a better investment experience.

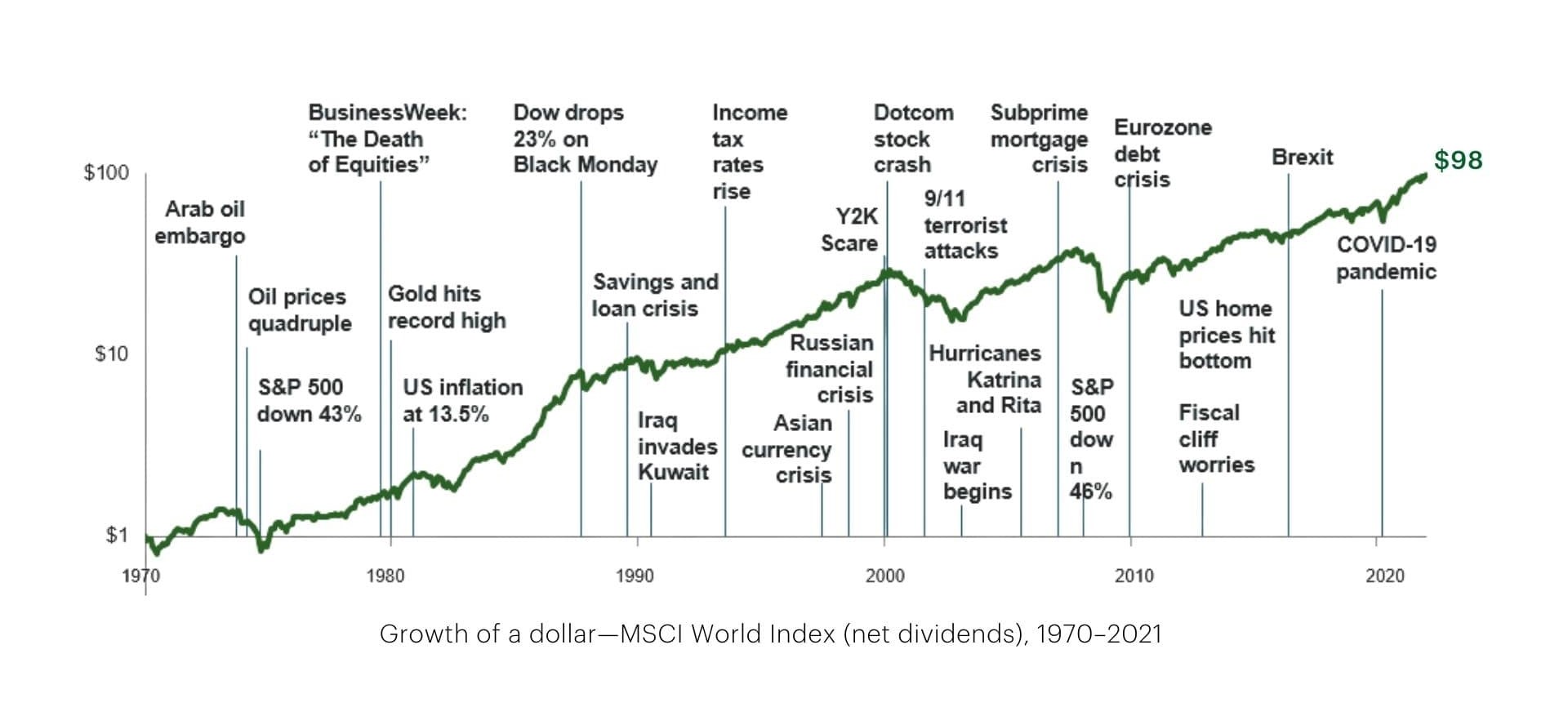

If you zoom out, equities markets have risen an exceptional amount over the last 50 years. Seasoned investors have experienced steep declines in the value of their portfolios; however, this volatility is the price you pay to generate wealth in equity markets over time. If there was no volatility, but the equity returns remain, everyone would be investing and everyone’s wealth would not change on a comparative basis. It is the volatility that keeps many investors out of the market or waiting until the market is “calmer”.

As you can see from the chart above, there have been countless events that have caused short-term panic in financial markets. However, with the benefit of hindsight, many of these events were blown out of proportion or even irrelevant.

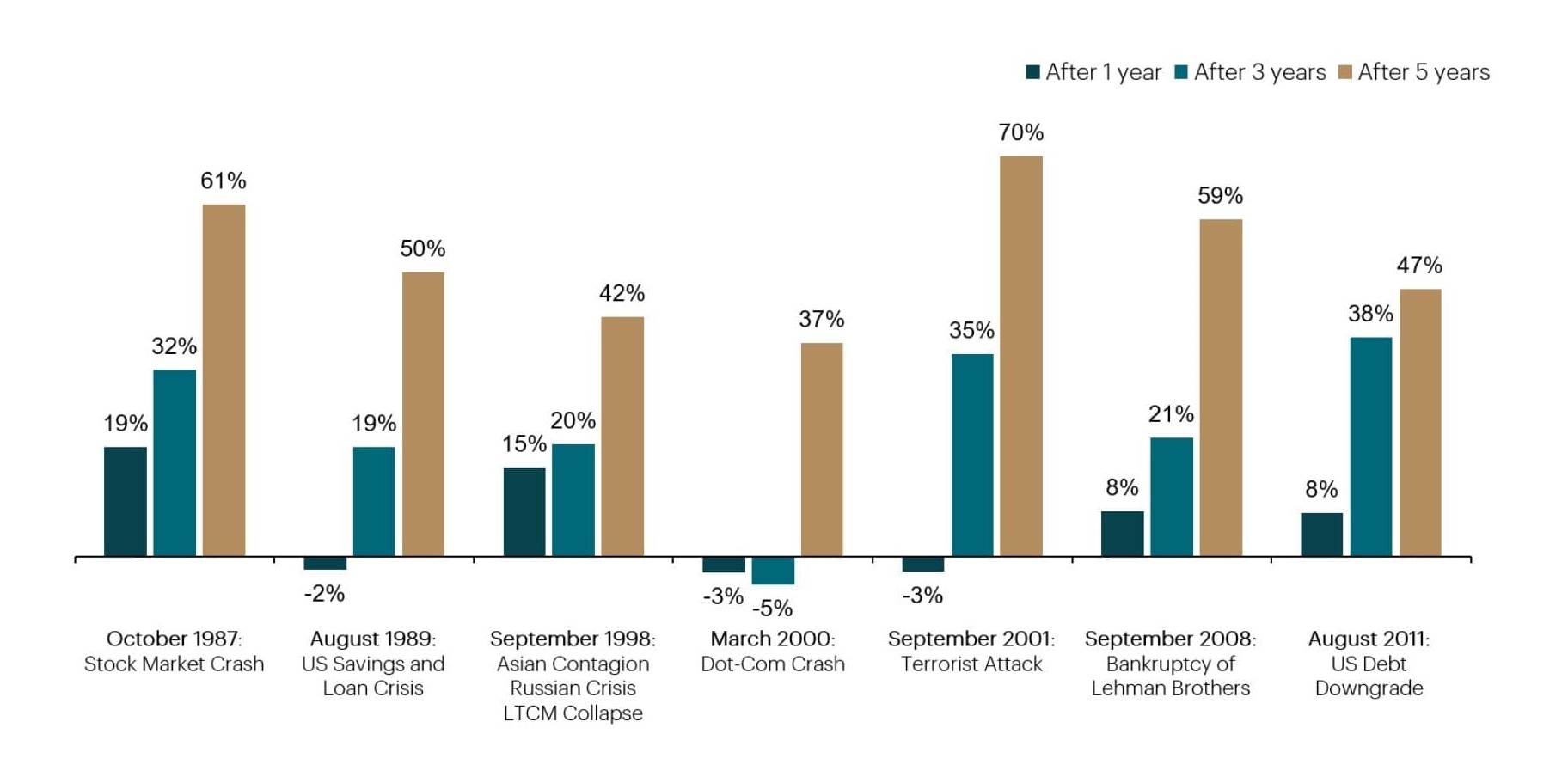

The chart below reiterates this point. In 2008, the stock market dropped in value by almost half and whilst the events of the crisis were unfolding, a full recovery looked anything but certain. Being an investor can be a worrying experience, and the feelings of panic and dread felt by many during the financial crisis were distinctly acute. Many investors reacted emotionally to market decline and in the heat of the moment, some decided it was more than they could stomach, so they sold out of stocks. On the other hand, many who were able to stay the course and stick to their approach recovered from the crisis and benefited from the subsequent rebound in markets.

Understanding how our emotions can impact our decision-making, we believe in taking a stoic approach to investing. This requires discipline to tune out the noise and look beyond the headlines, and instead focus on the things that you can control:

Adopting this approach certainly helps to reduce your stress levels. That being said, we understand that it is not easy dealing with high market volatility. If you’re feeling overwhelmed, you may feel the urge to withdraw from the markets – which can negatively impact your long-term personal and financial goals.

Here’s where a wealth manager can help you stay the course, prioritise things that matter and find balance with your risk tolerance, emotions, and achieve your overall goals.

For better web experience, please use the website in portrait mode