Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Friday, March 24, 2023

Written By

Financial Advice | Financial Planning | Investing | Portfolio

Savings and investing are two wealth-building concepts that are required for a financially secure future. While they’re often conflated, the two are very different. The main thing that separates them is risk: savings are a way to hold onto your assets with minimal risk, whilst investing strives for more growth in exchange for taking on more risk.

With inflation reaching 9.4% in 2022, rising prices is one of the biggest motivations to grow our assets, else our purchasing power decreases year on year. In this article, the differences between saving and investing will be explained, along with the importance of effective asset allocation.

When you save money, you are simply preserving its value. The money you save today will have the same purchasing power in the future, but that is it. Inflation is constantly eroding the value of your savings, which means that the longer you wait, the less valuable your money becomes. Even a 2-3% inflation rate can erode your purchasing power significantly over time.

Some amount of savings is important. An integral part of responsible personal finance is to prepare for the worst and avoid insolvency. An emergency fund needs to be highly liquid, hence for an emergency, and very safe. Cash is the primary option for an emergency fund because of its liquidity. Whilst its value may be less each year, we already know this and can plan for it. Inflation may fluctuate but it’s most commonly a positive figure, so we can view it as a form of insurance that we pay in exchange for liquidity.

There are two main drawbacks to saving our money. The first is that inflation directly harms our savings. Prices around us generally get more expensive whilst our savings get left behind. A reduction in purchasing power directly relates to a reduction in living standards. The second drawback of savings is opportunity cost. This is the return we forgo by not investing our money, and instead, take a smaller reward in the form of interest.

One consideration for savings is that it can allow for more flexibility when investing. Whilst waiting to buy the dip isn’t necessarily optimal, having reserves to adjust a portfolio or capitalise on an opportunity can be conducive to an investing strategy.

Investing is the number one way to overcome the threat of inflation. Whilst the returns on our investments may not outperform inflation every year, not investing would make retirement planning much more difficult.

Whilst time is our biggest threat when holding cash due to inflation, time is our biggest asset when investing. Compounded returns, for example, is a phenomenon that thrives with more time.

The goal of apportioning a portfolio to a variety of different assets is to balance risk, reward, goals, and time horizons. While some assets are suited to an emergency fund or deposit building, they’re not optimal for pension and estate planning.

For many young people, owning the perfect family home is an immediate objective while retiring early is a longer-term vision. This could cause a conflict in strategy because an equity-heavy portfolio with a 25-year time horizon will put the deposit money in jeopardy. One can withstand business cycles, whilst the other cannot. A common way to avoid this is by simply holding cash for the deposit and investing the rest.

Long-term investing is a strategy that involves buying and holding investments for an extended period of time, typically five to ten years or more. The idea behind this approach is to allow the investments to grow and compound over time, which can lead to significant returns.

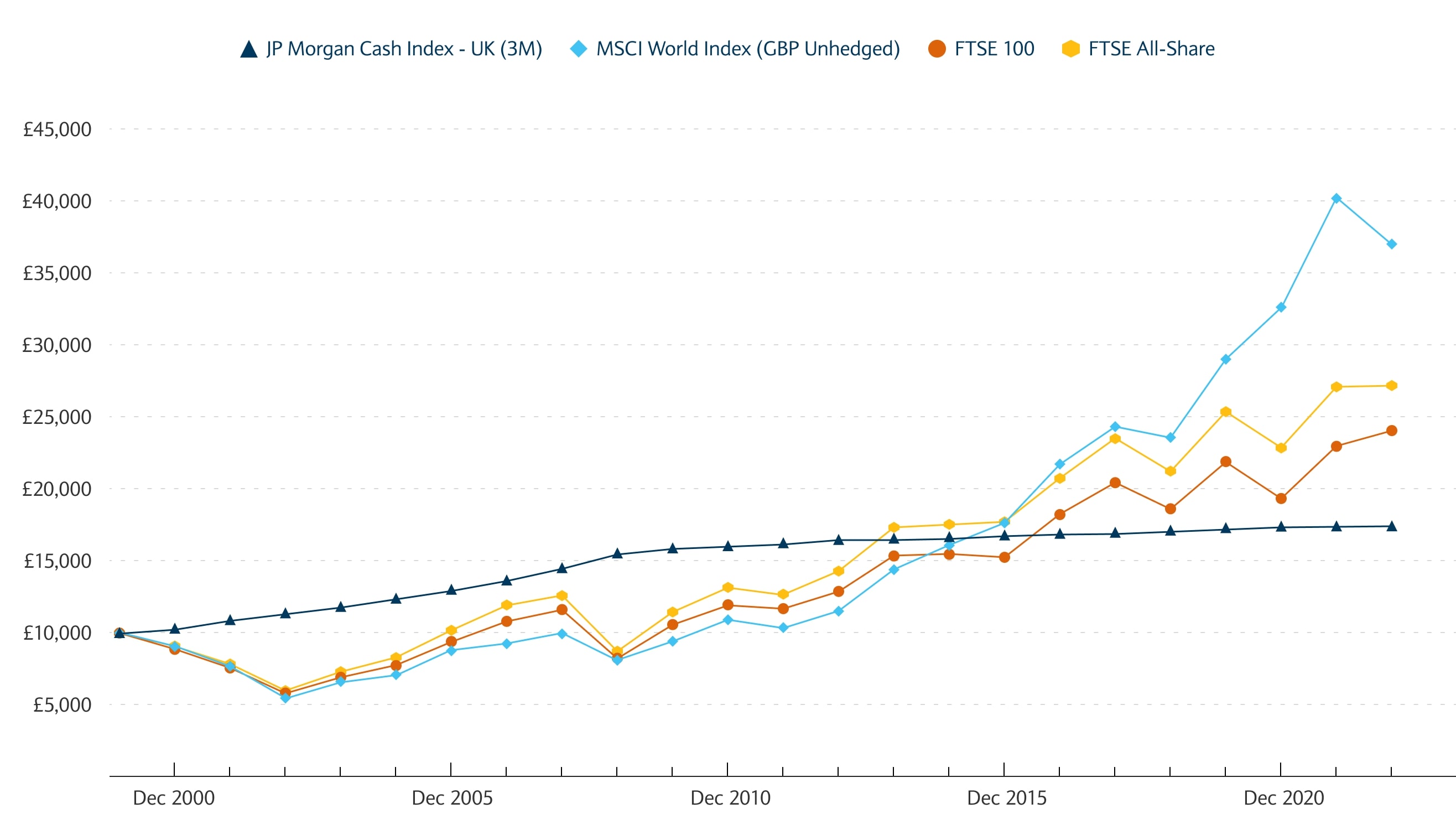

For example, if the inflation rate is 2% per year, $1,000 today will only be worth $820 in ten years. By contrast, investing that $1,000 in the stock market, which has historically returned an average of around 10% per year, could result in a return of over $2,000 in the same time frame. This is illustrated in the graph below, which shows the difference in returns between investing in the MSCI World Index, FTSE 100 and FTSE All-share versus holding cash over a 20-year period.

The stock market is volatile, and prices can fluctuate widely in the short-term. However, over the long-term, the market tends to trend upward. By investing regularly over time, investors can take advantage of the market's upward trajectory and potentially benefit from buying investments at lower prices during market downturns.

In contrast, those who sit on cash may miss out on these opportunities to buy at a discount and benefit from future growth. Usually, when investors see their cash holdings losing value due to inflation, they may be tempted to make hasty investment decisions to recoup their losses. This can lead to a cycle of buying high and selling low, which is a recipe for poor returns.

While saving your money is important, merely letting it sit idle in a savings account is not the best financial strategy. Investing strategically can generate even more wealth and help you beat inflation, manage risk and achieve your financial goals.

When it comes to inflation-hedged investment, it’s important to note assets do not perform independently of inflation. It’s not a matter of the higher the historical returns, the better the inflation hedge. Some investments, like US stocks, have a dip in performance during periods of high inflation.

With the help of a qualified financial adviser, you can be assured of avoiding the erosion of your cash without neglecting your short-term goals. Through exclusive investments, a rebalancing strategy, and listening to your objectives, a portfolio can be constructed that withstands economic and geopolitical adversity.

For better web experience, please use the website in portrait mode