Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Friday, February 17, 2023

Written By

Financial Advice | Employee Benefits | Corporate Culture

When the rising use of food banks and personal debt dominates the news, it may be easy to forget that white-collar workers also endure financial stress. When around 25-40% of employees from wealthy countries like Switzerland, Singapore, and the UK live paycheck to paycheck, it’s clear that financial stress isn’t just a poverty issue.

This stress carries over into their work life, and a Willis Towers Watson report highlights that finances are the number one stress suffered by over 50% of employees, whilst 1 in 3 claims that it is a distraction to their work.

From an employer's perspective, keeping a happy and healthy workforce is important to productivity. But, it doesn’t just end within the parameters of the office. Physical and mental well-being is the core of company well-being strategies, but finances are a significant factor in both. CIPD research shows that 28% of people have lost sleep, developed anxiety, and found it hard to make decisions at work due to financial stress.

In such difficult times following a pandemic and increasing global inflation, developing a programme for financial well-being has never been so important.

The most immediate step to take is within insights. Here, employees can express their needs and concerns through feedback, surveys, and focus groups. Communication and accessibility are very important, ensuring that you have a functioning platform to begin from.

Next, a strategy is developed by identifying a vision, outcomes, and corporate objectives. Existing well-being programmes should be compared to the results of the insights, highlighting where they fall short but, equally, where they perform well and add value.

When delivering the programme, technology platforms and processes may need updating. Employees should be made aware of the new programme and what it has to offer through effective communication.

Companies can measure results through KPIs - including any response in productivity and ROI – and, ultimately what is and isn’t working to improve well-being. Employee feedback should be ongoing, meaning the five steps above are cycled through again. This way, the financial well-being policy remains relevant and up to date.

Reducing financial stress through an effective well-being policy not only increases productivity, but it reduces absenteeism and employee turnover. An effective financial well-being policy for employees may make them more innovative, leading to better career progression, and finding work more fulfilling.

The most immediate impact a company can have is through monetary benefits. This is where their daily financial stress can be improved, and it’s not just about giving a better paycheck.

One example of how context and feedback are key, and how not all money is created equally, is on the topic of healthcare. Employees in countries with private healthcare may deem comprehensive healthcare insurance as a priority. Again, context over employees’ environments, like the pandemic and state support, is taken into consideration.

Some employees live with free healthcare but poor state pension arrangements. Such employees may deem life and critical illness insurance as more important. Both can help protect employees from the most serious of life situations, but the well-being created per dollar amount spent changes with context. This also highlights how physical and mental health are closely tied to finances.

The percentage of the global population that is over 65 is growing, highlighting two things: state pensions may struggle and people are living longer. Of that age group, 15.5% still work and this is expected to rise. Retirement planning has never been so important, yet 45% of residents in the UAE are yet to start saving for retirement. Statistics are similarly concerning in the UK and South Africa.

Effective pension plans are therefore another important area to tackle in financial well-being. Taking care of retirement planning can also help employees focus on their current savings, like building a deposit.

Finally, some consideration is given to the modernisation of benefits. In the UK, vision and dental insurance could replace general health, as might subsidising therapy, gym memberships, and early access to wages.

It’s important to consider that education can improve many day-to-day financial struggles. When money management is absent from the curriculum of most countries’ education systems, employers can step in. Without knowing how best to manage money, aforementioned financial benefits like early access to wages may make less of an impact.

Webinars are a good vehicle to deliver financial education, particularly with the increased propensity to work from home. Some topics to present include:

Being a process of thought, stress is an emotional and psychological strain. Because it is in our mind, having more confidence and education can help employees even before any material change has occurred. This is why engagement when delivering financial education is paramount and can have synergistic effects when combined with mental health programmes.

Gaining even a small level of financial independence (i.e. having a 3-month emergency fund) can have a significant improvement in well-being. Many people aren’t aware that their spending is exceeding their income, or how to calculate their savings ratio.

Equally, it’s important to understand the order of financial priorities. Is it better to overpay on high-interest debt or use that money as an emergency fund? Should they be investing when they could be overpaying on the mortgage? Such specific questions could also highlight a need for interactive webinars that create a more personalised conversation.

Webinars and other forms of education can only provide so much one-on-one time. For more intensive advice and bespoke financial solutions, a financial advisor can help share unique knowledge and maximise returns on any investments made. Or, more importantly, limit mistakes that lead to further stress.

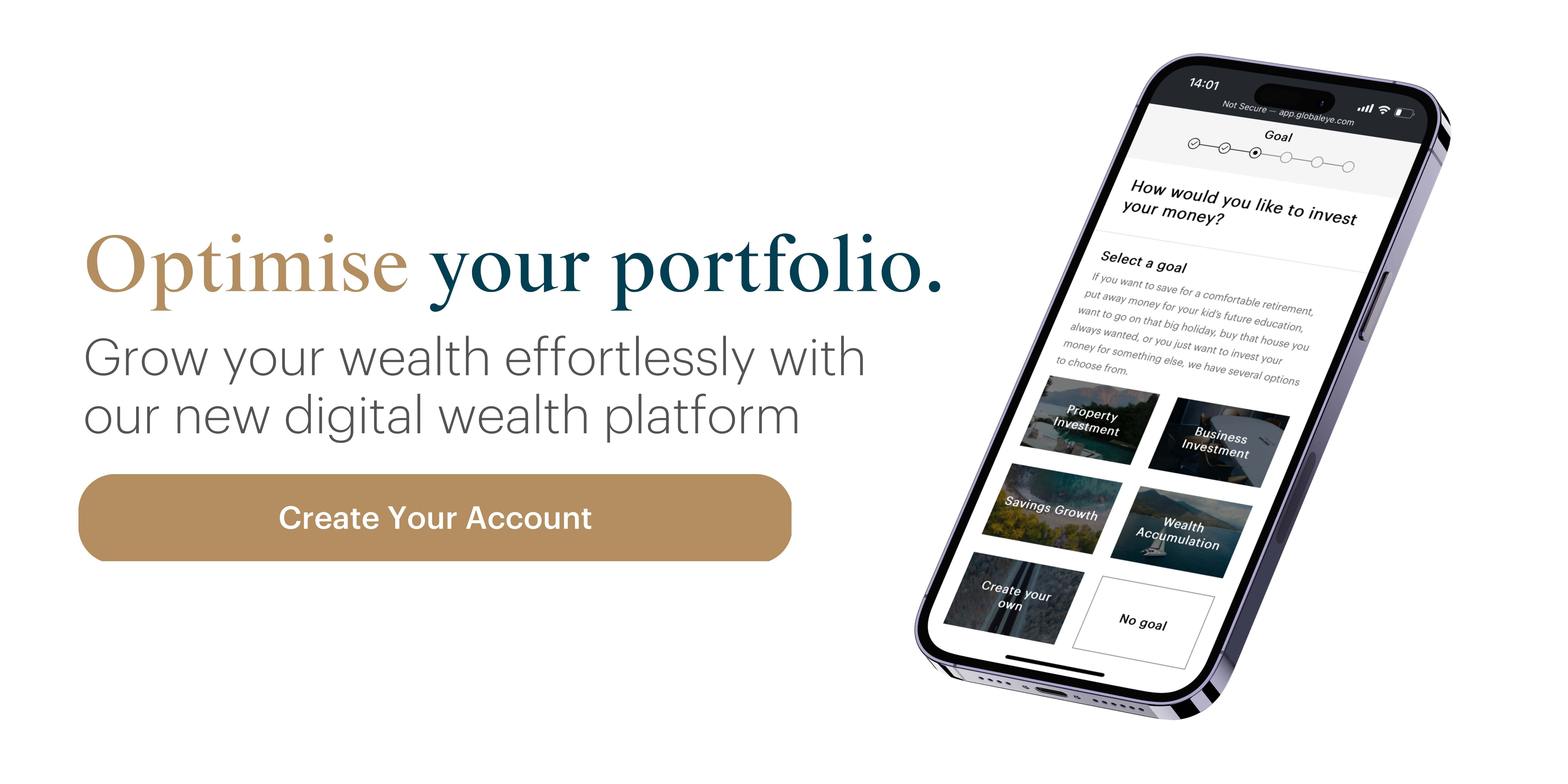

Our team of accredited advisers, and other partner professionals, can provide employee benefit services to help achieve company welfare objectives. Through our new model portfolios and financial planning, we can also help employees achieve their own specific financial goals.

For better web experience, please use the website in portrait mode