Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

Monday, August 21, 2023

Written By

Financial Advice | Investing | Alternative Investments

In the world of investment, art and collectables have emerged as alternative assets that offer unique opportunities for both financial growth and personal enjoyment. In fact, art and investment have long been married together, but it has been an asset class that is exclusive and inaccessible, reserved only for affluent individuals and families, until now.

But, art should be enjoyed by everyone. And, unlike stocks and bonds that dominate traditional portfolios, they bring some distinct advantages.

Collectables, by definition, hold a unique benefit: they possess an intrinsic value that transcends the cold, impersonal digital numbers often associated with conventional investments. This tangible value stems from various factors - their scarcity, their connection to critical points in history, their artistry, or perhaps even sentimental value and our own personal development.

Investing in collectables can be solely a financial decision, but it doesn’t have to be. Who’s to say that investments cannot be enjoyed in other ways, or embrace emotions? So long as your judgement isn’t clouded by this, and it instead runs parallel; it’s a myth that non-financial motivations in your decisions can only hinder your portfolio.

Art and collectables have barriers to entry. Thorough knowledge and research are essential, and they come with high volatility. This can make it a challenging investment, and a risky one, but there are rewards to be realised far beyond sentiment.

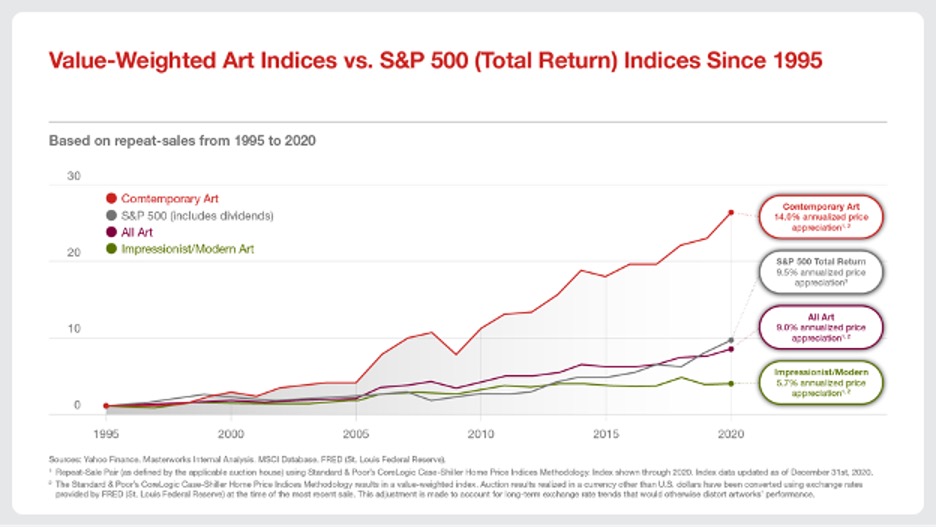

Graph: www.nomuraconnects.com

As per the graph above, contemporary art has consistently outperformed the S&P 500 index. The Mei Moses All Art Index, which encapsulates the broader art market, returned a compound annual growth rate of 8.5% from 1950 to 2021. Investment-grade wines, vintage cars, sports memorabilia, and stamps have also boasted impressive returns, many of which have beaten traditional commodities.

Though, it is contemporary art which often experiences the highest returns due to having a broader market appeal, media and celebrity influence, along with being a bit more speculative. 12-15% annual returns since the mid-1990s means that art has outperformed the S&P 500 by 3 to 6% each year, on average.

When talking about art transcending monetary value, this isn’t just painting a picture of sentiment, it’s a matter of taxation, too. Art remains a core part of tax-efficient estate planning in many countries; from free ports that protect investments from VAT to tax-reducing museum donations. Therefore, when considering the returns on investment adjusted for taxation, collectables can become even more compelling.

Clearly, artistic assets are volatile, but nobody is arguing in favour of them being the backbone of a portfolio, but rather a supplementary asset. In fact, an even more important reason to consider collectables isn’t just the high potential returns, but the diversification benefits.

Art has a very low correlation with stocks, bonds, and real estate, which can help reduce the systemic risk of a portfolio despite its inherent volatility. This means that even in bear markets, the value of your art holdings may remain stable - or even see gains.

Geographical diversification is also in abundance with collectables, from Japanese woodblock prints to African tribal art. There are ample opportunities to look internationally. The time required to research an art investment may be greater than with, say, an international stock, but the research is more often driven by a genuine interest and passion for the asset.

Whilst this could pose issues of bias, it also means that many people who hold collectables know a lot about their own holdings, more so than many stockholders can say. And, expertise in a niche field can lead to networking opportunities, provide (legal) information asymmetry advantages, and potentially a high-profit ceiling.

When investing in collectables, there are risks far beyond general price volatility. Here are some areas of consideration before making any investments:

Liquidity: Unlike stocks or bonds which are very liquid and quickly sold, selling a rare collectible might demand patience and time, impacting liquidity.

Maintenance, Storage, and Insurance: Many collectables have specific care requirements. Artworks may need climate-controlled environments, and vintage cars might require meticulous maintenance. This isn’t just an extra cost that eats into any potential gains, but also a cost on your time. And, because they’re precious, you will want to insure them.

Authentication and Provenance: In the world of collectables, authenticity isn't just a bonus; it's everything. Ensuring that a collectable is genuine demands rigorous due diligence. Engaging domain experts and seasoned professionals for evaluations and certifications are needed, which again costs money.

Market Knowledge: If you’re picking out individual investments, the collectables market, in stark contrast to the transparent nature of traditional markets, can be elusive and indistinct. A comprehensive understanding of emerging trends, along with a well-cultivated network of trustworthy dealers, are invaluable.

Tax Implications: Art is often portrayed as a way to mitigate tax. However, this assumption could mislead you into unexpected tax bills. Depending on your jurisdiction, you may still be subjected to capital gains tax, inheritance tax or other levies.

Art and collectables present exciting opportunities as investment assets. They combine a high ceiling for potential financial gains with our desire to preserve a piece of history, culture, or artistic expression.

However, careful consideration, due diligence, and expert advice are crucial to navigate this market successfully. For those looking to learn more about investments in collectables, please reach out.

For better web experience, please use the website in portrait mode