Private Clients

Helping you discover more with your time through bespoke wealth management

Some of the products listed on our website may not be available in certain regions due to regulatory reasons. Please contact our local offices to speak to a qualified financial advisor.

By continuing to the website I accept the cookie policy

NFT's as modern art, how to secure your art collection and mitigate tax liabilities, ‘cyber insurance' as a growing trend, getting bespoke advice to protect your high-value assets.

Friday, May 20, 2022

Written By

Intergenerational Wealth Transfer | Investing | Portfolio | Lifestyle

Worth $65.1 billion in 2021, the art world exemplifies exclusivity to some and elitism to others. But the ‘art world’ always shifts in response to new ideas and technologies.

More recently, this was seen when the worlds of art and programming collided through NFTs. While many still grapple to understand what an NFT is, others see value in the new artform and are more than willing to pay for it.

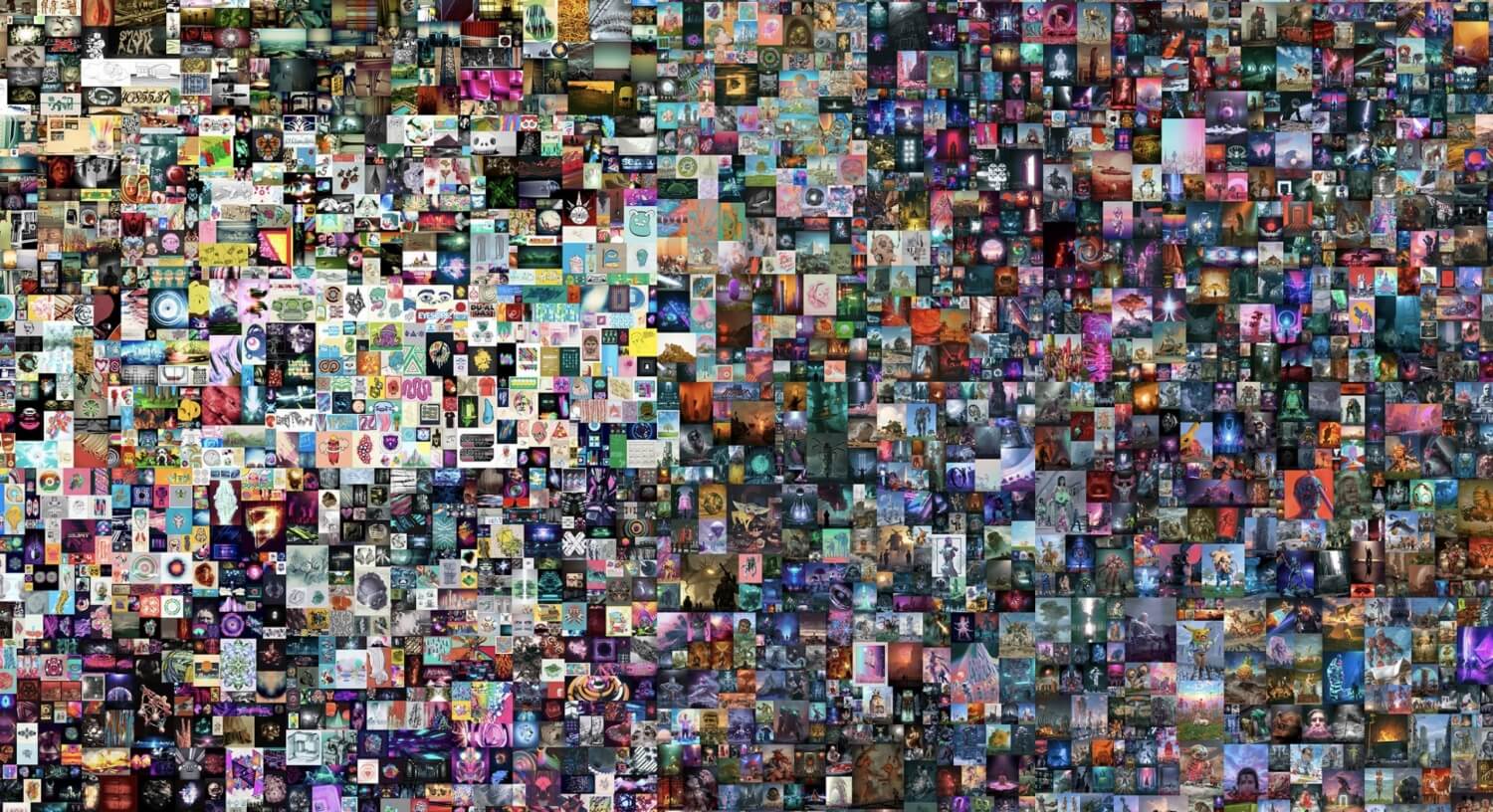

In 2021, many (including the artist himself) were awe-struck to see Beeple’s digital artwork – titled Everydays: The First 5000 days – sell at Christie’s for $69.3 million. Bought by tech-entrepreneur Vignesh Sundaresan, the NFT signified a huge turn in the art world.

A world that was historically kept to the elite had now merged with a cyber world founded on principles of decentralisation and anti-establishment. With just as many critics as supporters, debate lingers over how NFTs fit into the art world and one question has yet to be answered - are NFTs here to stay?

Through history, fine art hung in lavish galleries of the Louvre and ordained the walls of the Sistine Chapel. Studying Art History has long been associated with the royals and upper classes, but the late 20th century saw a turn.

Since the 1980s, the art world has shifted to appreciate Contemporary Art much more than any time previously. Andy Warhol was famed for breathing new life into the art world by blending art with pop culture and advertising culture.

He redefined art as a ‘business’ – and made it a big business. His most expensive artwork recently sold for $195 million.

2017 saw Christie’s auction off the most expensive painting ever sold – Leonardo da Vinci’s ‘Salvator Mundi’ selling for an unbelievable $450.3 million.

While the enormous expense of da Vinci and Raphael are understood, the art world’s reputation as being pretentious is furthered by the less-than-understood artworks that sell with huge price tags.

A humorous, yet apt, example is the case of the $120,000 banana.

In 2019, ‘artwork’ of a banana duct-taped to a wall was sold for $120,000. It appropriately shows how ‘value’ has a different definition in the art world.

As Forbes’ Dani Di Placido points out, meaning (and value) is given to artwork by the people in the community. So, in more ways than anywhere else, the subjective value of art is dependent on the community who sees it.

To those not in, it might not make much sense but (to put it in economic terms) so long as one group – however big or small – sees subjective value in an artwork, it means there is demand. And where there is demand, there is financial value.

It’s in this new, perhaps lesser understood, part of the art world that we see the most radical transformation. More specifically with blockchain.

While the price of art soared, so came a new wave of art through NFTs. An NFT (Non-Fungible Token) is in basic terms something that can’t be replicated or replaced with something else. It is a digital asset based on blockchain technology that authenticates ownership over something, whether that be digital artwork or another type of creation, like music. An NFT allows the artist a way to register their ‘one of a kind’ creation, very similar to copyrighting a piece of music.

In theory, when we consider art, it is not too different from a physical artwork’s provenance, which is an artwork’s documented proof of authenticity and ownership.

But the loosely understood blockchain nature of NFTs, sparked intense global conversation when they began selling for hundreds of thousands (if not millions) of dollars.

Though, as mentioned previously, when trying to understand the value of art, it doesn’t necessarily have to be about understanding the art itself as much as understanding the people that it attracts.

NFT artworks speak to a whole new audience. It’s decentralised and distinct. Futuristic and progressive. It’s not for everyone, it’s for a new generation that values the digital world.

At an Art Basel NFT event in Miami, Washington Post journalist Sebastian Smee witnessed first-hand the group of people NFTs are attracting. While there, he observed flocks of Crypto and Blockchain entrepreneurs swoop in on their newfound interest in art.

But the ‘Crypto’ interest goes beyond the stunning artwork on display and into the core behind the art – the blockchain. It’s a platform that they can relate to and, much like Vignesh Sundaresan’s interest in buying The First 5000 Days, boosting the price of NFT art by proxy boosts the blockchain value beneath it.

This shows that there is a group of people who give value to NFT and are not just thinking in the short term. Even more, as more value is given to NFTs, it is attracting the attention of more traditional HNW collectors too.

In a report published by Art Basel, in partnership with UBS, 2339 HNW collectors – across 10 markets – were surveyed to understand the HNW trends in the art world.

While the largest takeaway from the report was how quickly the art market was able to rebound following its 2020 Pandemic downturn (a rebound predominantly supported by HNW collectors), there was insight on the opinions of NFTs.

Without a doubt, NFTs have caught the attention of HNW collectors globally. As many as 88% of those surveyed stated that they are interested in purchasing NFT artworks in the future, with only 4% saying they were not.

Even more, they found that 76% of collectors had already purchased NFTs of some kind.

This comes alongside findings that an increased proportion of HNW portfolios are being dedicated to art. More specifically, 64% reported a portfolio allocation of over 10% invested in art. The number goes up when it comes to younger HNW collectors.

Gen Z collectors had the highest average share of wealth dedicated to art, with over a third having an allocation of more than 30% (compared with Millennials with 27%, and Gen X who had 24%).

Art continues to hold meaning. Its creation and documentation might now involve technology – much like every other part of our life – but no admiration has been lost for the classics. It remains to be a form of reflecting on our worldview. So, while some turn to Van Gogh’s material representation of life, for others, it takes a new digitized universe.

More traditionally, the fine art market continues to be approached with prudence. While there is the general fear that a chosen artwork’s future value will not appreciate, leading concerns for HNW collectors revolve around legal and regulatory issues, not to mention the risk of damage, or indeed theft.

Stark lessons were learnt through the early 2000’s when the art world found it had been defrauded of $80 million in fake artwork by Glafira Rosales, who was found guilty of fraud, money laundering, and tax evasion in 2013.

In fact, ‘Salvator Mundi’ (the above-mentioned da Vinci) was itself caught up in a lengthy legal battle after its previous owner, a Russian oligarch, claimed he was defrauded by the Swiss art dealer who sold it to him.

If you are a fine art collector or thinking about building a collection, there are a number of important things to consider. First and foremost, is ensuring that your art is insured to cover any potential risks e.g. theft or damage.

With art being an asset, careful planning is essential to mitigate tax liabilities and typically different structures are utilised to hold these assets, such as a trust or private placement life insurance (PPLI) policy.

The answer is yes, ‘cyber insurance' is a growing trend. In simple terms, there is a risk transfer from the purchaser to the insurer over ‘cyber’ risks associated with owning digital assets.

For example, an NFT will have a ‘set of keys’, one public and one private. The digital ledger will have the public key, whilst the investor will retain the private one, in essence representing proof of ownership. The investor would most likely have insurance to protect against the loss of the private key, and would be compensated accordingly.

Understandably, NFT protection solutions are complex, and very much in it's infancy with not too many institutions adding cyber insurance to their product suite. A challenge for the insurance industry is how to price cover, since non-fungible means there is no benchmark to compare against.

It is essential therefore that individuals should take advice, ensuring that they are fully protected, but more importantly understand the coverage and the exclusions.

For better web experience, please use the website in portrait mode